How the Luxury Watch Industry is Zeroing in on Female Sports Fanfare

First, it was fashion. Then it was makeup. Next, it’s watches.

As sports stars become the next big thing in luxury fashion, watch brands are beginning to sign female players on the pitch and courts as cover stars. The only thing they’re missing is on-track talent.

Tissot was ahead of the curve in 2005 when former IndyCar driver Danica Patrick partnered with the watch company as an ambassador. Since 2022, endorsements have flooded the female sports arena. Hublot sponsored the UEFA Women’s European Football Championship for the second time and Olympic Gold Medalist Shelly-Ann Fraser-Pryce signed an endorsement deal with Richard Mille in 2023 just as the company launched its first collection of women’s sports watches. Track star Sydney McLaughlin-Levrone, pro skateboarder Sky Brown, surfer Maya Gabeira, world champion swimmer Summer McIntosh and tennis players Petra Kvitovà and Naomi Osaka all make up TAG Heuer’s roster of female athletes.

Luxury fashion brand Hermès, making wristwatches since 1928, announced last week its first complete line of women’s sports watches. Anticipated to compete with the likes of Chanel and Rolex, the $218 billion company’s collection reflects the globe’s newfound appetite for female athletes.

However, the luxury watch industry has yet to capitalize on the female racing market.

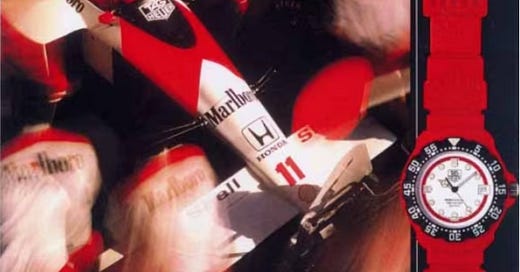

Formula 1 is all about counting the seconds. When Heuer debuted the “Time of Trip” clock in 1911, it’s no surprise the luxury watch company became a staple in car racing. Three years later, it would conveniently transform from a mounted timepiece on vehicle dashboards to a watch sitting on the wrists of Europe’s new favorite athletes.

In the 1930s, Rolex entered the world of fast cars and big personalities, popularized by Sir Malcolm Campbell, who routinely set land speed world records in Daytona. So, when the green and gilded crown logo became practically fused to F1 after Sir Jackie Stewart held the Formula One Drivers’ World Championship title for the first time in 1969 — a year after becoming a Rolex ambassador — and won it again in ‘71 and ‘73, Rolex, now controlling 30 percent of the luxury watch market, became synonymous with success.

As technology advanced, a simple timer wasn’t necessary. Luxury watch brands, turning their attention to Europe’s growing racing scene, swapped out supplying stopwatches in favor of driver sponsorship deals. It was less about keeping time and more about drawing the attention of the sport’s wealthy audiences.

Now, a watch is the winning prize in racing. The 24 Hours of Daytona, also known as the Rolex 24, awards a watch to the team of drivers who make it through the night in one piece and cross the Florida track’s finish line first. Rolex became the official timekeeper for F1 in 2013 after Heuer, Longines and Hublot all took turns.

Now, just as each F1 athlete aligns with a team, nearly all 20 drivers are tied to a watch brand.

After a race, the top three finishers hop out of their cars, step onto the scale, the helmets come off and the watches slide on before even taking a swig of water. From the pages of GQ and the billboards in Times Square to the podium, racing drivers have become the face of luxury watch brands. Red Bull Racing has TAG Heuer (famously worn by Niki Lauda, Ayrton Senna and Mario Andretti), Scuderia Ferrari and McLaren’s drivers sport Richard Mille’s “racing machines on the wrist,” Mercedes teams up with IWC Schaffhausen while Girard-Perregaux’s logo sits beside the Aston Martin wings. Ahead of 2024, Alpine switched from Bell & Ross to H. Moser & Cie and Visa Cash App Racing Bulls welcomed new watch sponsor Tudor. Previously, Oris and Tissot had stints as sponsors in the racing series.

Even F1’s famed “Piranha Club” of off-track bosses have snagged endorsements. When a “gang of millionaire muggers” stole former F1 CEO Bernie Ecclestone’s watch in 2010, Hublot included a photo of his black and blue beaten face in an advertisement with the quote “See what people will do for a Hublot.” It ran in the Financial Times.

According to TAG Heuer, the first women’s watch was clasped onto the wrist of Napoleon Bonaparte’s sister, the Queen of Naples, in 1810. Over 200 years later, the luxury sports watch industry is beginning to recognize the marketability of female athletes. Its timing is convenient.

When South Carolina beat Iowa in the final round of March Madness on April 7, a record number of people turned on their TVs. ESPN reported that the game’s 18.7 million viewers made history as the largest audience in the last five years. The college women’s basketball match outperformed the NBA and men’s NCAA. Shortly before the garnet and black confetti engulfed the stadium, female athletes set another record. Global revenues from women’s sports hit a record high of $1 billion in 2024, three times the amount reported just three years earlier.

From a Caitlin Clark cameo on SNL to Prada enlisting the women’s star as the first basketball player — male or female — dressed by the brand for Monday’s draft to former NBA player Shaquille O’Neal deeming the women’s March Madness tournament “a better game” than men’s NCAA, women’s sports is mainstream.

The racing world is no exception.

F1 Academy acts as a platform to build up girls and women as big names in motorsport with the intention of an eventual F1 debut. From fashion endorsements to media rights deals, it’s racing to catch up to both the surge of F1 and women’s sports in popularity.

Following the success of Netflix’s “Drive to Survive,” the all-female series is attempting to create a similar hype as F1 — which reached record viewership and profits over the past two years — by airing the bite-sized 30-minute races on YouTube free of cost and signing a docuseries rights agreement. Ahead of the 2024 season, F1 Academy inched closer to securing a steady fanbase by gaining global broadcasting coverage.

Each F1 team is linked with an F1 Academy counterpart, like Mercedes’ backing of Doriane Pin and Alpine sponsoring Abbi Pulling. Yet, few have inherited the sponsorship deals currently tacked onto F1 teams. The series’ managing director, Susie Wolff, has used the opening to attract brands that may not traditionally enter male-centric sports.

At the start of the series’ second year in March, Charlotte Tilbury became the first beauty brand to sign a partnership with the racing series and Tommy Hilfiger, a fashion brand tied to Mercedes until the end of 2024, kitted out drivers in its women’s clothing line. Now, both representatives of the fashion and beauty industries market themselves on the sides of race cars and the sleeves of female drivers’ coveralls.

The deals reflect a heightened awareness of the trendiness of women’s sports, a message echoed by The Business of Fashion earlier this month which argued “It’s Time for Beauty and Fashion to Get Serious About Female Athletes.”

“The F1 Academy is a project developed by Formula 1 to propel female drivers in their motorsport careers and it is a savvy business move: 40% of F1 fans are women, contributing to a total 2022 season viewership of over 1.5 billion,” Cindy Riccio, executive vice president of 360PR+ and the manager of the women-centric PR firm CRC, told Forbes. “Charlotte Tilbury just became the first female-founded beauty brand to sponsor F1, leveraging its worldwide reach to highlight F1 Academy's talented drivers, spotlighting their accomplishments, and demonstrating to their audience the myriad opportunities for women in motorsport, both on and off the racetrack.”

The luxury watch industry’s heavy hand across the history of racing and newfound affinity for female athletes makes a partnership with F1 Academy seem inevitable. However, few brands have signed on female racing drivers previously. Documentation of women’s watches in the sport is brief, centering on the wives and girlfriends of former drivers who would sit trackside during races with stopwatches at the ready. Watch brands rarely sponsored Maria Teresa de Filippis, Lella Lombardi and the handful of other female F1 drivers. Giovanna Amati was one of the few seen sporting a Swatch Grand Prix.

But for Hermès, and the European watch market as a whole, strapping a watch to a fresh-faced female racing driver might be just the thing to repair its reputation.

Last month, two California residents sued Hermès over alleged antitrust violations. Luxury fashion giants all have one fundamental premise that drives business: exclusivity. Hermès, however, takes the concept to new heights. Customers are unable to purchase the highly-coveted Birkin bag, made famous by its namesake Jane Birkin, unless they have a long receipt of past purchases with the brand. The purses, which retail second-hand for upwards of $450,000, aren’t available online or in-store for purchase, the lawsuit argued. Instead, sales associates present the bags in private rooms with the intention “to coerce consumers to purchase ancillary products,” the plaintiff alleged.

As Europe’s luxury watch industry plummets — falling 40 percent in secondary market value over the past two years due to inflation and lagging economic growth — the wave of female sports stars in the public eye could be the niche companies have waited for to lift a sinking sector.

Female athletes have always been stars, just the unspoken kind and labeled as unmarketable. The sticker price of women’s sports franchises continues to be undervalued, even as popularity peaks. In January, the NCAA announced a $920 million ESPN media rights agreement with 40 championships bundled together through 2032. The men’s media rights package was separate while the women’s was not. Female athletes are also met with discount job offers. Salary estimates began circulating shortly after the Indiana Fever chose Clark as the first WNBA draft pick. As The Cut’s Tuesday afternoon headline read, whatever amount of zeros she deposits will be “a lot less than the NBA first pick, that’s for sure.” As female athletes are paid less than men across the sports industry, brand endorsements offer an opportunity to bridge the gap.

For athletes, backing from a luxury watch brand goes further than other sponsorships, according to The New York Times. Roger Federer, a top-paid tennis player, made $95 million of his $95.1 million in revenues from endorsements in 2023. Rolex has signed Federer’s checks since 2006.

In the world of luxury watches, the benefit could be two-fold: brands are zeroing in on female athletes when those players, drivers and competitors may be just the thing to save their bottom line.